Loan annuity formula

Finally the formula for cost of sales can be derived by adding beginning inventory step 1 raw material purchase step 2 cost of direct labor step 3 and overhead manufacturing cost step 4 minus ending inventory step 5 as shown below. An approximation for annuity and loan calculations.

Annuity Payment Pv Formula With Calculator

Of periodic payments step 2 a period of delay step 3 and rate of interest step 4 as shown below.

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

. The future value of an annuity formula is used to calculate what the value at a future date would be for a series of periodic payments. I is the interest rate per month in decimal form interest rate. The tenure of the fund is 10 years and the annualized nominal interest rate offered is 4.

FIFO First IN First OUT Method. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. The present value PV formula has four variables each of which can be solved for by numerical methods.

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. Ordinary Annuity P 1 1 r-n 1 r t r The annuity due formula can be explained as follows. FV of an Annuity Due FV of Ordinary Annuity.

Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. An annuity is based on. The rate does not change 2.

Each of the other formulae is derived from this formula. So if the market environment is inflationary ending inventory value will be higher since items which are purchased at a higher. A loan by definition is an annuity in that it consists of a series of future periodic payments.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. The formula for Future Value of an Annuity formula can be calculated by using the following steps. Nper C612.

Jefferson earned the annual interest rate of 481 which is not a bad rate of return. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. In this method items which are purchased first will be sold first and the remaining items will be the latest purchases.

Methods For Calculating Ending Inventory. Firstly calculate the value of the future series of equal payments which is denoted by P. So you can think of a loan as an annuity you pay to a lending institution.

Formula to Calculate PV of Ordinary Annuity. Next calculate the effective rate of interest which is basically the expected market interest rate divided by the number of payments to be done during the year. 10481 1 r.

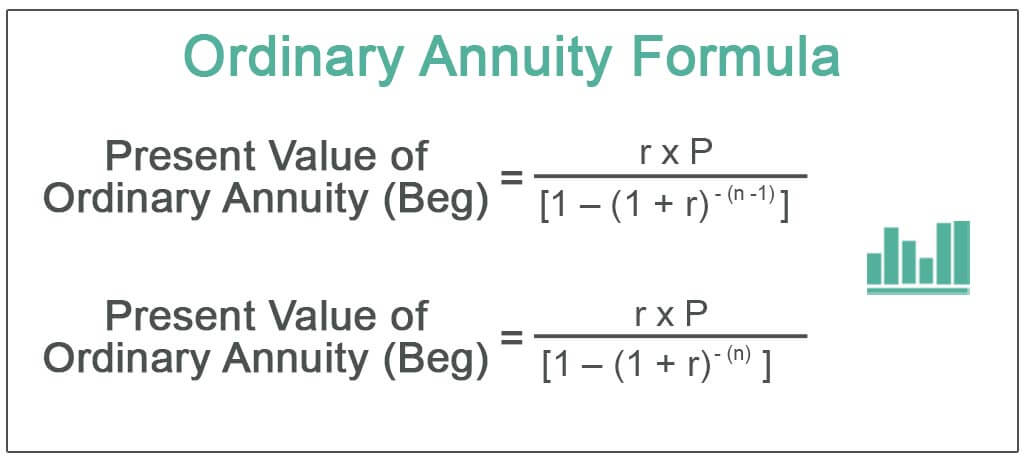

Finally the ordinary annuity formula can be expressed on the basis of the annuity payment step 1 no. Ordinary Annuity Formula refers to the formula that is used to calculate the present value of the series of an equal amount of payments that are made either at the beginning or end of the period over a specified length of time. PMT is the monthly payment.

Each cash flow is compounded for one additional period compared to an ordinary annuity. Find the monthly payment total cost total interest and more. An annuity is a series of payments made at equal intervals.

PVdfracPMTileft1-dfrac11inright PV is the loan amount. The first payment is one period. The last difference is on future value.

There are 3 different ways of calculating ending inventory. For example the annuity formula is the sum of a series of present value calculations. The tenure of the loan is denoted by t Step 4.

Let us take the example of David who has recently invested a sum of 20000 in a long term deposit fund. The future value of an annuity formula assumes that 1. In the example shown the PMT function is configured like this.

PMT loan payment. Next figure out the rate of interest to be paid on the loan and it is denoted by r. The formula to calculate auto loan payments is shown below.

A portion of each payment is for interest while the remaining amount is applied towards the. For 25 years after retirement. There is an approximation which is less intimidating easier to compute and offers some insight for the non-specialist.

Finally the formula for simple interest can be derived as a product of outstanding loan amount step 1 interest rate step 2 and tenure of the loan step 3 as shown below. An annuity is a series of equal cash flows spaced equally in time. Annuities can be classified by the frequency of payment dates.

Users may download the financial formulas in PDF format to use them offline to analyze mortgage car loan student loan investments insurance retirement or tax efficiently. To calculate the monthly payment with PMT you must provide an interest rate the number of periods and a present value which is the loan amount. The governing formulas of each finance functions are also available with corresponding calculators to help learners or students to know what formula is being used to find.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. A mortgage is an example of an annuity. The formula used to calculate loan payments is exactly the same as the formula used to calculate payments on an ordinary annuity.

The formula for Amortized Loan can be calculated by using the following steps. If the inflation rate during the period is expected to be 2 then calculate the real interest rate as per the full formula and the approximate formula. For loan calculations we can use the formula for the Present Value of an Ordinary Annuity.

The present value formula is the core formula for the time value of money. The original loan amount. Next determine the tenure of the loan or the period for which the loan has been extended.

The above formula 1 for annuity immediate calculations offers little insight for the average user and requires the use of some form of computing machinery. The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it. You have 20 years of service left and you want that when you retire you will get an annual payment of 10000 till you die ie.

Annuity Formula Example 2 Let say your age is 30 years and you want to get retired at the age of 50 years and you expect that you will live for another 25 years. The payments deposits may be made weekly monthly quarterly yearly or at any other regular. What is Mortgage Formula.

The formula can be expressed as follows. Of years which is denoted by t. As per the formula the present value of an ordinary annuity is calculated by dividing the Periodic Payment by one.

Next determine the loan tenure in terms of no. Firstly determine the current outstanding amount of the loan which is denoted by P. The PV or present value portion of the loan payment formula uses the original loan amount.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. An annuity dues future value is also higher than that of an ordinary annuity by a factor of one plus the periodic interest rate. The borrower makes payments that are calculated by using the formula for an ordinary annuity.

Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by David is 20882 and 20624 in case the payments are received at the start or at the end of each quarter respectively. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

Annuities And Loans Math For Our World

Finance Formulas Owll Massey University

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Find Monthly Installment For Loan Present Value Annuity Example Youtube

Annuity Present Value Pv Formula And Calculator Excel Template

Excel Formula Annuity Solve For Interest Rate Exceljet

Ordinary Annuity Formula Step By Step Calculation

Annuities And Amortization Ppt Download

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Solve For Remaining Balance Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Annuity Due Formula Example With Excel Template

Loan Amortization Using Present Value Of Annuity Formula Youtube

Excel Formula Payment For Annuity Exceljet

Loan Balance Formula Double Entry Bookkeeping

Excel Formula Payment For Annuity Exceljet